Contents

Should you be considering taking out a different type of loan, give our standard loan calculator a try. What is a balloon payment? A balloon payment is a large, lump-sum payment made at the end of a long-term loan. It is commonly used in car finance loans as a way of reducing monthly repayment figures. Be aware that once you reach the end of.

Farm Credit Amortization Schedule balloon payment amortization Schedule Bankrate.com provides a FREE balloon mortgage calculator and other arm calculators tools to help consumers compare mortgages.. Mortgage payment calculator ; Amortization calculator.Amortization Schedule Calculator Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. AgCarolina – Glossary – AgFirst farm credit bank serves 20 acas, including agcarolina farm credit, A mortgage loan with an amortization schedule longer than.

In some loan terms you can pay off the balance of the loan minus the balloon payment if the balloon isn’t due within the next few payments. While a balloon payment can help you get your business started with initial lower loan terms, the payment can also come back to bite you, down the road.

Check out the web’s best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes, homeowner’s insurance, HOA fees, current loan rates & more. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules.

Mortgage Payment Definition Verb []. mortgage (third-person singular simple present mortgages, present participle mortgaging, simple past and past participle mortgaged) (transitive, law) To borrow against a property, to obtain a loan for another purpose by giving away the right of seizure to the lender over a fixed property such as a house or piece of land; to pledge a property in order to get a loan.Refinance Balloon Mortgage Refinancing is the process of obtaining a new mortgage in an effort to reduce monthly payments, lower your interest rates, take cash out of your home for large purchases, or change mortgage companies. Most people refinance when they have equity on their home, which is the difference between the amount owed to the mortgage company and the worth of the home.

Free loan calculator to determine repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds. Also, learn more about different types of loans, experiment with other loan calculators, or explore other calculators addressing finance, math, fitness, health, and many more.

Most people who lease a car don’t know how much of each monthly payment is being pocketed by the finance company as a fee. With a balloon auto loan, the interest rate is made crystal clear up front.

The low interest will tempt you to take it, but if you don’t calculate it correctly, your total payment could make you pay more. This balloon loan payment template is a simple excel tool to help you calculate it roughly. It is intended to give you a simple illustration on this type of loan payment. How to Use it :

The low interest will tempt you to take it, but if you don’t calculate it correctly, your total payment could make you pay more. This balloon loan payment template is a simple excel tool to help you calculate it roughly. It is intended to give you a simple illustration on this type of loan payment. How to Use it :

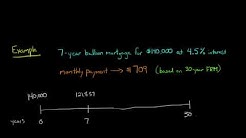

How to Calculate a Balloon Payment in Excel. While most loans are fully paid off throughout the life of the loan, some loans are set up such that an additional payment is due at the end. These payments are known as balloon payments and can.